Setting up a business in Delaware is an attractive option for entrepreneurs due to its business-friendly regulations and efficient processes. With the help of House of Companies, we ensure that your business registration is seamless and compliant with local government requirements.

We start by helping you choose between a sole proprietorship, limited liability company (LLC), or corporation in Delaware. We ensure that your business structure aligns with your operational goals and long-term strategy by thoroughly assessing your company objectives. This critical phase influences tax responsibilities, liabilities, and operational flexibility.

Once a corporate structure is selected, we assist in preparing and submitting the necessary paperwork to the Delaware Division of Corporations. This includes registering your business name, obtaining a Certificate of Incorporation or Formation, and applying for a Federal Employer Identification Number (EIN). We ensure all registrations comply with Delaware state laws and regulations as well as federal requirements.

Our entity management services encompass initial registration and ongoing support to maintain your firm's compliance with Delaware legislation. This includes annual reports, franchise tax filings, tax compliance, payroll administration, and other tailored administrative services. Our dedicated customer support team is available to address inquiries, keep you informed about regulatory changes, and help navigate any challenges related to business growth.

We provide more than just registration services; we offer a comprehensive solution that allows you to focus on growing your business. With our expertise and commitment, you can enter the Delaware market with confidence, knowing that experienced professionals will handle all aspects of your company setup and maintenance. From start to finish, we simplify the process of expanding internationally or launching a new business in Delaware.

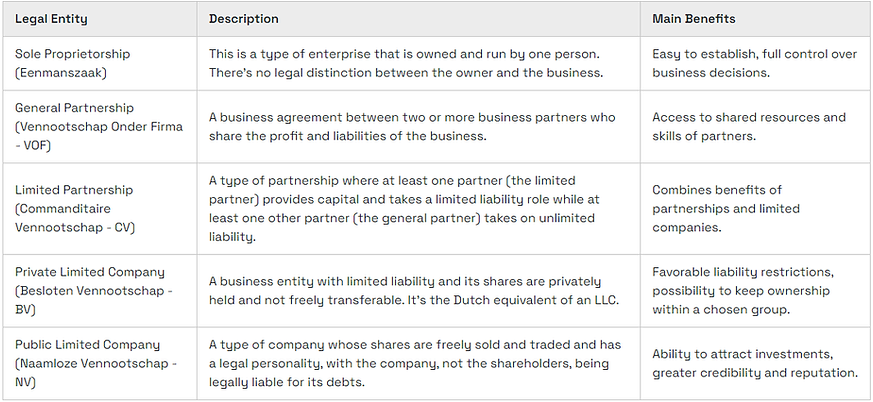

When it comes to company formation in Delaware, there are several different types of companies available to entrepreneurs.

One popular option is the Limited Liability Company (LLC). This type of company provides limited liability protection to its owners, meaning they are not personally responsible for the company’s debts. LLCs in Delaware also benefit from pass-through taxation, which can be advantageous for many small businesses.

Another option is the Corporation, which can be further categorized into C Corporations and S Corporations. C Corporations are typically used for larger businesses and allow for multiple classes of stock and an unlimited number of shareholders. On the other hand, S Corporations are designed for smaller businesses, allowing them to avoid double taxation by passing income directly to shareholders, who report it on their personal tax returns.

For those looking for a more informal business structure, the General Partnership is a viable option. In a General Partnership, two or more individuals share ownership and management of the business. However, unlike an LLC or corporation, partners in a General Partnership are personally liable for the company's debts.

Additionally, Delaware offers the Sole Proprietorship, which is the simplest form of business entity. This structure allows an individual to operate their business without forming a separate legal entity, giving them full control over business decisions. However, the owner is personally liable for all debts and obligations of the business.

Delaware also recognizes Limited Partnerships (LP) and Limited Liability Partnerships (LLP). In an LP, one or more general partners manage the business and assume unlimited liability, while limited partners have limited liability and do not participate in management. An LLP, on the other hand, protects all partners from personal liability for business debts, making it a popular choice among professionals.

Finally, Delaware has provisions for Nonprofit Corporations and Cooperatives, each with specific legal requirements and purposes. Each type of company has its own advantages and drawbacks, so it is essential for entrepreneurs to carefully consider their business goals and needs before deciding on the most suitable structure.

It is crucial to seek professional legal and financial advice to ensure compliance with Delaware regulations and tax laws. At House of Companies, we offer tailored support to our clients through our Corporate Plan. For a fixed fee, you will receive a bespoke and interactive report covering all your requirements, including free updates and a Compliance Calendar for a year in case of any changes in the law.

Regardless of the type of company formation chosen, all businesses in Delaware must register with the Delaware Division of Corporations if they intend to conduct business in the state. This registration process is essential to ensure compliance with local regulations and to maintain good standing.

When considering starting your company, the option of registering a business in Delaware is highly inviting for foreign firms desiring to enter the U.S. market. Known for its business-friendly environment, Delaware offers an entrepreneurial spirit coupled with a robust legal framework, making it an ideal location for entrepreneurs worldwide. It’s no wonder that Delaware is one of the most flexible avenues for leveraging this promising market.

The standout feature of registering a business in Delaware is the flexibility it provides. Delaware allows foreign companies to engage in trade activities without the burden of forming a completely local company. This approach is particularly favorable for organizations aiming to evaluate the U.S. market's suitability without binding commitments or intimidating setup procedures.

Moreover, in many cases, foreign businesses can operate in Delaware without needing to establish a local entity or register a branch. Activities such as applying for a federal Employer Identification Number (EIN) or hiring employees can be executed without forming a local entity, further underscoring the system's inherent flexibility.

Incorporating a company in Delaware can be a relatively swift process, especially when compared to other states. The entire procedure can typically be completed within approximately 1-5 working days. For businesses with careful planning and all necessary paperwork in order, same-day service is even possible.

Firstly, you will need to decide on the legal structure of your company, whether it’s a sole proprietorship, partnership, limited liability company (LLC), or corporation. Once this decision is made, you will need to choose a unique name for your company and ensure it complies with Delaware naming regulations.

Next, you will need to prepare a Certificate of Incorporation for your business. This document outlines the basic information about your company, such as its name, registered agent, and the nature of the business. Unlike other jurisdictions, Delaware does not require bylaws or operating agreements to be filed with the state, providing additional flexibility.

After drafting the Certificate of Incorporation, you must file it with the Delaware Secretary of State and pay the necessary filing fees. Opening a business bank account and depositing any required share capital can also occur during this process.

Understanding Delaware taxation is crucial for individuals and businesses operating in the state. The Delaware tax system includes corporate income tax, gross receipts tax, franchise tax, and personal income tax. These taxes create a favorable environment for businesses and individuals, making Delaware a popular choice for company formation.

Delaware offers several benefits for businesses and individuals. One significant advantage is its lack of a state sales tax, which can enhance profit margins for retail and service businesses. Furthermore, Delaware has no personal income tax for non-residents, making it an attractive location for business owners and employees who work remotely.

Delaware is known for its business-friendly corporate laws and regulations, including a streamlined incorporation process and a specialized court system (the Court of Chancery) that handles corporate disputes. This legal framework adds to the appeal of Delaware for multinational companies and startups alike.

Companies incorporated in Delaware are subject to the state's Corporate Income Tax (CIT) on their income derived from doing business within the state. The current CIT rate is 8%, which is competitive compared to other states in the U.S. Unlike some states, Delaware does not tax businesses on income earned outside its borders.

Delaware imposes a gross receipts tax on the total revenue of a business, regardless of profitability. This tax is applied to most businesses operating within the state and varies based on the type of business activity. Rates range from 0.0945% to 0.7468%, depending on the specific classification of the business. Unlike a sales tax, gross receipts tax applies to all revenue generated, providing a consistent revenue stream for the state.

Delaware's franchise tax is assessed annually on businesses registered in the state, with the amount depending on the company's structure and authorized shares. The tax rates vary significantly, with a minimum tax of $175 for corporations. Companies can opt for either the authorized shares method or the assumed par value method to calculate their franchise tax, providing some flexibility in how they manage their tax liabilities.

Delaware residents are subject to personal income tax, which is progressive and ranges from 2.2% to 6.6%, depending on the income level. Non-residents are only taxed on income earned within Delaware, making it advantageous for remote workers and entrepreneurs based outside the state.

Employers in Delaware are responsible for withholding payroll taxes from their employees’ wages. This includes the state wage tax, which is an advancement of the federal income tax, as well as social security and Medicare contributions. Delaware also imposes a state unemployment insurance tax, which employers must pay.

Companies in Delaware may also be subject to other taxes, including local taxes imposed by municipalities and specific industry-related taxes. However, the absence of a state sales tax and the competitive corporate tax rates position Delaware as a favorable jurisdiction for business operations.

Entrepreneurs starting a business in Delaware can benefit from numerous tax incentives designed to stimulate business growth. Here are some of the prominent incentives available:

Delaware does not impose a corporate income tax on businesses that operate outside the state. This means that if your business is registered in Delaware but conducts its activities elsewhere, you can enjoy significant tax savings. This unique structure makes Delaware a highly attractive location for corporations looking to minimize their tax liabilities.

Delaware offers a favorable franchise tax structure for businesses, particularly for LLCs and corporations. The state has a relatively low franchise tax rate compared to many other jurisdictions, providing financial relief to businesses operating within the state. This tax is calculated based on the company’s authorized shares or the assumed par value of the shares, allowing businesses to choose the most advantageous method for their situation.

Delaware provides various economic development incentives aimed at attracting new businesses and supporting existing ones. The Delaware Economic Development Authority (DEDA) offers grants and loans to businesses that meet specific criteria, including job creation and investment in certain sectors. These financial incentives can significantly offset initial startup costs and enhance business viability.

Similar to the Netherlands' tax incentives for R&D, Delaware offers tax credits for businesses engaged in research and development activities. Companies investing in innovative projects may qualify for tax credits that reduce their overall tax burden. This incentive encourages businesses to invest in new technologies and improve their products or services.

Delaware also supports businesses through various workforce development programs. These initiatives often include tax credits for companies that provide training to their employees. By investing in workforce development, businesses can enhance their capabilities while benefiting from tax savings.

Fill out the form below to register.

All established companies in Delaware must:

Maintain and File Records: Companies are required to keep accurate and complete financial records. This includes bookkeeping and maintaining all necessary documentation for their financial activities.

Prepare Year-End Financial Statements: Companies must prepare year-end financial statements, which typically include a balance sheet, income statement, and statement of cash flows, in accordance with the chosen accounting framework.

Fulfill Additional Statutory Reporting Obligations: Depending on the nature of the business, companies may need to meet specific statutory reporting obligations, including annual franchise tax reports and any other reports mandated by local government agencies.

This includes adhering to the Delaware Financial Reporting Framework and, if applicable, the Generally Accepted Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS).

Regarding audit requirements, Delaware law mandates:

Small Companies: In general, small companies may not be subject to mandatory audits unless they meet certain thresholds or have specific agreements requiring one.

Medium and Large Entities: Medium and large entities must undergo mandatory annual audits by a registered external auditor. This requirement ensures that financial statements provide a true and fair view of the company's financial position.

Additionally, when foreign residents establish a company in Delaware, they are expected to adhere to the same financial reporting and audit requirements as any domestic company. This involves complying with Delaware financial reporting standards and undergoing an audit as stipulated by Delaware law.

Failure to comply with financial reporting and audit requirements in Delaware may result in legal consequences, fines, and penalties. It is crucial for foreign residents and new business owners to familiarize themselves with these requirements when forming a company in Delaware.

At House of Companies, we provide comprehensive support in navigating the financial reporting and audit landscape in Delaware. Our experienced team assists clients in:

Setting Up Efficient Record-Keeping Systems: We help establish effective systems for maintaining accurate financial records to meet legal obligations.

Preparing Year-End Financial Statements: Our experts guide clients in preparing compliant financial statements that reflect their business accurately, whether using GAAP or IFRS.

Navigating Audit Requirements: We assist clients in understanding their audit obligations and connect them with reputable registered external auditors to ensure compliance.

With our dedicated support, clients can focus on their core business operations while ensuring that their financial reporting and audit requirements are handled efficiently and correctly.

Hiring personnel in Delaware is relatively straightforward, thanks to a business-friendly environment and a diverse labor market. The state boasts a skilled workforce characterized by a strong educational background, excellent communication skills, and a flexible approach to work. Delaware's recruitment culture emphasizes mutual compatibility and professionalism, making it an attractive location for businesses seeking to hire.

Delaware is home to numerous professional recruitment agencies that specialize in various sectors and employment levels. These agencies possess extensive knowledge of the local job market, facilitating the recruitment of skilled personnel for new businesses. Utilizing these agencies can significantly streamline the hiring process, ensuring that companies find the right talent for their needs.

The Delaware labor market is notably flexible, with a wide availability of both part-time and full-time contracts. This flexibility allows companies to tailor their workforce organization to best fit their operational requirements. Additionally, Delaware has a relatively low unemployment rate, which can make it easier for businesses to find qualified candidates.

Internet job portals, professional networking sites, and social media platforms are widely utilized in Delaware for recruitment purposes. Posting job advertisements online enables businesses, especially startups, to reach a broad audience of potential employees. Leveraging these digital tools can enhance recruitment efforts and improve the chances of finding the right candidates quickly.

It's important to note that Delaware has specific labor laws that must be adhered to during the recruitment process. These laws encompass areas such as non-discrimination, data privacy, and fairness in employment contracts. To ensure compliance, companies may benefit from consulting local legal experts or engaging HR service providers who are well-versed in Delaware's employment regulations.

Starting a business in Delaware also involves comprehending and adapting to the state's wage structure and employment policies. Delaware's labor system provides significant protections for workers, including a regulated minimum wage and overtime pay, ensuring fair compensation for employees.

For entrepreneurs, it’s crucial to be aware of the higher wage standards in Delaware compared to many other states. Additionally, Delaware law stipulates that employers are responsible for providing paid sick leave, which adds another layer of financial responsibility for businesses.

Due to these regulations, many businesses in Delaware express concerns about the complexity and financial burden associated with hiring staff. The high costs linked to wages, benefits, and compliance with tax obligations can be challenging for employers, particularly small businesses or startups.

However, while these regulations may appear burdensome, they reflect Delaware's commitment to fostering a fair and equitable labor market. It is essential for entrepreneurs considering the Delaware market to take a structured approach toward workforce planning, budgeting, and compliance with local labor laws to ensure their business operates successfully and sustainably.

Intellectual property protection in Delaware is crucial for any company seeking to safeguard its innovations and creative works. Protecting intellectual property involves filing for patents, trademarks, or copyrights with the appropriate authorities. This process establishes ownership and prevents unauthorized use or copying of your intellectual property.

In Delaware, the U.S. Patent and Trademark Office (USPTO) handles patent and trademark applications. Companies can file for protection by submitting their applications, which will undergo examination for compliance and originality. Once approved, businesses should actively monitor for any infringement and be prepared to take legal action if necessary. This may include sending cease-and-desist letters, pursuing litigation, or negotiating licensing agreements. A proactive approach to intellectual property protection is essential for safeguarding innovations in the competitive Delaware market.

In Delaware, businesses require various permits and licenses to operate legally. The specific permits needed can vary widely depending on the type of business and the industry. For example, a general business license is mandatory for all businesses operating in the state.

Certain sectors, such as hospitality, healthcare, and construction, may require additional permits, such as health permits, building permits, or professional licenses. It is crucial for companies to thoroughly research the specific permit requirements relevant to their industry and locality. Consulting with legal or industry experts can help ensure compliance with all necessary regulations.

Maintaining accurate and up-to-date records of permits and licenses is essential for demonstrating compliance and avoiding potential fines or legal issues. By following these guidelines, companies can operate confidently within the legal framework of Delaware.

To form a company in Delaware, you need to:

The foundation of a successful company in Delaware involves meeting all legal requirements and understanding the local business environment. Additionally, you need to:

Understanding these requirements is crucial for successfully establishing a company in Delaware.

At House of Companies, we provide comprehensive support to our clients navigating the complexities of forming a business in Delaware. Our experienced team assists with the entire process, from choosing the appropriate business structure to filing necessary paperwork and obtaining permits and licenses. We help ensure compliance with local regulations, allowing clients to focus on growing their businesses.

With our expertise and guidance, clients can confidently establish their companies in Delaware, protecting their intellectual property and navigating the regulatory landscape effectively.

A Delaware LLC (Limited Liability Company) must adhere to various ongoing obligations related to financial reporting and compliance. These requirements ensure transparency, accuracy, and adherence to Delaware state law. Here’s a breakdown of some key aspects:

Delaware LLCs are required to pay an annual franchise tax and file an annual report, although the reporting requirements for LLCs are less stringent than those for corporations. The annual tax is due by June 1st each year. While there is no detailed financial reporting for LLCs, failure to pay the franchise tax may result in penalties, interest, and potential dissolution of the LLC.

Unlike many other states, Delaware does not require LLCs to publish their formation in a newspaper. However, if the LLC has registered to do business in other states, it may need to comply with publication requirements in those jurisdictions. Non-compliance in those states may result in fines or inability to conduct business.

Delaware LLCs must maintain accurate and complete records of their financial activities, including financial statements, operating agreements, and member meetings. While not required to file these documents with the state, having them readily available is essential for compliance and can be crucial in legal proceedings.

The Delaware LLC structure is recognized for its flexibility, allowing businesses to customize their operations and governance according to their specific needs. This flexibility arises from minimal capital requirements, broad member rights, and customizable governance structures, making it an attractive vehicle for both small and large enterprises.

Delaware LLCs can have one or more members, which can be individuals or entities, providing flexibility in deciding ownership and control of the company.

The operating agreement outlines the governance of the LLC, including management, voting rights, profit distribution, and member responsibilities. This document can be tailored to meet the specific needs of the members and is critical for the operation of the LLC.

Members can choose to manage the LLC themselves or appoint managers. This flexibility allows for a variety of management structures, whether member-managed or manager-managed, adapting to the operational requirements.

Delaware does not impose a minimum capital requirement for forming an LLC, offering flexibility in structuring the company’s capital. Members can contribute cash, property, or services, with the operating agreement detailing these contributions.

Voting rights can be customized in the operating agreement. Members can create different classes of membership interests with varying voting powers, establishing decision-making processes that suit the needs of the LLC.

Once the structure is established, the LLC must be registered with the Delaware Division of Corporations. The necessary documentation includes the Certificate of Formation and any required fees.

After registration, the LLC must comply with Delaware corporate regulations, including annual tax obligations. The LLC must adhere to its operating agreement while following state laws, allowing for continued operational flexibility.

Delaware is highly attractive for foreign firms looking to enter the U.S. market. The state's business-friendly environment and established legal system make it an ideal location for entrepreneurs worldwide.

Delaware LLC registration provides significant flexibility, enabling foreign companies to engage in business activities without the need to establish a complex corporate structure immediately. This option allows businesses to assess the U.S. market with minimal commitment.

Incorporating a company in Delaware is a relatively swift process, often taking about 1-3 business days, depending on the service used and the accuracy of submitted documents. A same-day service is possible with proper planning and if all necessary paperwork is in order.

Decide on the Legal Structure: Choose whether to form an LLC, corporation, or another business entity.

Choose a Unique Company Name: Ensure the name complies with Delaware naming regulations and is available for use.

Draft the Certificate of Formation: Prepare this document, which outlines essential details about the LLC.

File with the Delaware Division of Corporations: Submit the Certificate of Formation along with the filing fee.

Obtain an Employer Identification Number (EIN): This number is necessary for tax purposes and is obtained from the IRS.

Open a Business Bank Account: Establishing a business bank account is essential for managing the LLC's finances.

While the incorporation timeline is short, the actual processing time can vary based on the complexity of the business structure and any additional regulatory requirements.

To register a company with the Delaware Division of Corporations, ensure you have the following documents ready:

Once these documents are submitted and the registration fee is paid, the LLC will be assigned a Delaware business entity number, allowing it to conduct business in the state.

Utilizing a virtual office address for your Delaware LLC can be a strategic and cost-effective approach, especially for startups and small businesses. A virtual office allows you to establish a business presence in Delaware without the need for a physical office, significantly reducing operational costs and increasing your business's flexibility.

One of the primary benefits of a virtual office is that it provides a professional business address, enhancing your company’s credibility. This is particularly important when engaging with clients, partners, or vendors who expect a local presence. A virtual office address allows you to keep your personal address private, ensuring a clear distinction between your business and personal life.

Delaware law requires that every LLC have a registered agent with a physical address in the state. A virtual office can serve this purpose by offering a registered address, allowing your business to comply with local regulations without the necessity of leasing or purchasing physical office space. This ensures that you remain compliant with the Delaware Division of Corporations’ requirements.

Many virtual office providers offer a suite of additional services, including mail forwarding, phone answering, and even meeting rooms. These services can enhance your business operations by ensuring that you never miss crucial communications, even if you're managing your business remotely. The availability of professional meeting spaces allows for in-person meetings when necessary, presenting a polished image to clients and partners.

For businesses operating internationally, establishing a virtual office in Delaware can simplify cross-border transactions. It provides a local point of contact, facilitating relationship building with Delaware customers, suppliers, and partners. This localized presence also grants access to Delaware's extensive business networks and resources.

Using a virtual office may also present tax-efficient opportunities. By having a registered business address in Delaware, your LLC may qualify for certain local tax benefits or deductions. Delaware is renowned for its business-friendly tax environment, including no sales tax and attractive corporate tax structures, making it an advantageous location for establishing a business presence.

The flexibility offered by a virtual office is a significant advantage. Whether you are expanding into new markets or scaling back operations, a virtual office allows for quick adjustments without the burden of long-term physical office leases. This adaptability is especially valuable in today’s rapidly changing business landscape.

A virtual office address can streamline administrative tasks for your Delaware LLC. Many providers offer digital tools to manage mail, scheduling, and communication, enabling you to concentrate on core business activities. This convenience can free up valuable time for entrepreneurs and managers, allowing them to focus on growth and strategy.

Registering a Delaware Limited Liability Company (LLC) can be a complex process, especially for foreign entrepreneurs unfamiliar with U.S. laws and regulations. Partnering with local experts simplifies the process, ensuring compliance with all legal requirements and providing valuable insights into the Delaware market. These professionals help navigate the paperwork, verify required documentation, and liaise with Delaware authorities, allowing you to focus on your business. With their guidance, the registration can be faster, smoother, and more efficient, preventing costly mistakes or delays.

Engage with local consultants who specialize in Delaware LLC registration to understand the requirements, procedures, and potential challenges. They will outline the steps involved and provide an initial assessment of your business needs, including any specific industry regulations.

With the guidance of experts, prepare essential documents such as your business plan, member details, and proof of identification. Local professionals will ensure that all paperwork meets Delaware’s standards, including the Certificate of Formation required to establish your LLC.

Local experts assist in choosing an appropriate company name and verifying its availability through the Delaware Division of Corporations. This step is crucial to avoid potential conflicts and ensure compliance with Delaware naming conventions.

While not required by Delaware law, having an Operating Agreement is highly recommended. Local consultants can help you draft this document, which outlines the management structure and operating procedures of your LLC, ensuring it aligns with both Delaware regulations and your business objectives.

Local experts can assist in opening a Delaware business bank account, a crucial step for separating personal and business finances. They can facilitate communication with banks and ensure a smoother process for funding your LLC.

Once all documents are ready, your local experts will help you submit the registration to the Delaware Division of Corporations, ensuring all details are correct and avoiding unnecessary delays.

After registration, local consultants will help you apply for a Federal Employer Identification Number (EIN) through the IRS and ensure your business complies with Delaware tax laws. They can also advise on ongoing reporting and compliance requirements, such as franchise taxes.

Using technology in business registration services has streamlined the entire process, making it more efficient and accessible. Traditional registration methods involved paperwork, long waiting times, and multiple visits to government offices. Today, with the integration of digital platforms, businesses can be registered online, reducing the time and effort required for entrepreneurs.

One significant advantage of using technology in business registration is the automation of processes. Automated systems can guide users step-by-step through the registration process, ensuring that all necessary forms and documentation are completed correctly. This minimizes human error and increases the accuracy of the information submitted.

Cloud-based platforms have also played a crucial role in modernizing business registration services. Entrepreneurs can now store and retrieve their documents securely online. This enables businesses to access their registration details from anywhere, at any time, fostering a more flexible and convenient process.

Moreover, e-signatures have revolutionized the way documents are signed and submitted during the registration process. By eliminating the need for physical signatures, e-signatures speed up the approval process and further reduce the reliance on paper-based systems, which are more prone to delays.

Technology has also improved the transparency of business registration services. Entrepreneurs can track the progress of their applications in real-time. This transparency builds trust in the system, allowing businesses to stay informed about any delays or requirements for additional documentation.

Artificial intelligence (AI) is another key player in enhancing the registration process. AI tools can analyze submitted documents for compliance, ensuring that they meet all regulatory requirements before submission, saving time and preventing rejection.

Additionally, online payment systems integrated into registration platforms offer seamless fee transactions, allowing entrepreneurs to pay their registration fees digitally. This eliminates the need for physical payment methods like checks or cash.

Lastly, technology has made business registration more accessible to small businesses and startups. Entrepreneurs from remote locations can easily access registration services without needing to travel, encouraging business growth across wider regions.

Am I prepared to launch my Entity?

I am prepared to begin trading.

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!